From The James Lathrop For Treasurer Campaign:

Bringing back COLA’s (Cost of Living Adjustments)

How would you feel if your loan application was denied because your neighbor had bad credit?

This is what is happening with the pensions under the control of the State Treasurer and something when elected I will change.

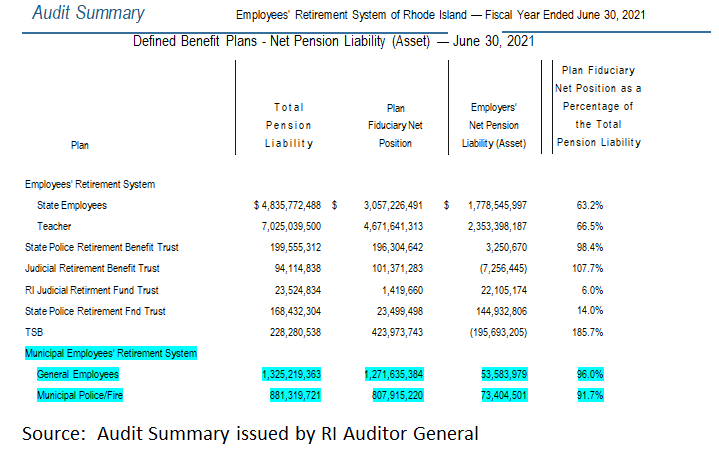

The 2021 Audit of the State Employee Retirement System issued by the States Auditor General shows that many of the municipal pensions, managed by the State have exceeded the 80% funding requirement.

The State has one investment fund but has multiple pensions. The pensions managed by the State are at 71% funded rate. This is due to State Employees (63.2% funded) and Teachers (66.5% funded). Municipal Employee plans; General Employees and Municipal Police/Fire are funded at 96.0% and 91.7%.

The State is denying City and Town employees the COLA’s they deserve, because of their failures. This must change. The Treasure must be able understand data and how it relates to people and operations.

Audit Summary Employees’ Retirement System of Rhode Island — Fiscal Year Ended June 30, 2021

Defined Benefit Plans – Net Pension Liability (Asset) — June 30, 2021

Plan Total Pension Liability Plan Fiduciary Net Position Employers’ Net Pension Liability (Asset) Plan Fiduciary Net Position as a Percentage of the Total Pension Liability

Source: Audit Summary issued by RI Auditor General

From The Diossa For Treasurer Campaign:

Diossa Responds to Lathrop’s COLA Plan

In a recent press release, my Republican opponent announced his plan to return cost-of-living adjustments (“COLAs”) to pensioners within the Municipal Employees Retirement System (“MERS”). After a cursory review of the 2021 audit summary of the state Employees’ Retirement System (“ERSRI”), my opponent concluded that MERS employees in local plans that have reached 80% funding status should be entitled to COLAs, whereas those with pensions in the ERSRI – whose pensions are relatively less funded – should not.

In his own words, “[t]he State is denying City and Town employees the COLAs they deserve because of their failures.” He continues by stating that “[t]he Treasurer must be able to understand data and how it relates to people and operations.” On this, I agree.

Had my opponent taken the time to review state law – or if he had understood the basic structure of the state pension system – he would have known that statutes already provide a cost-of-living adjustment for municipal plans within the MERS system once they reach 80 percent funding. While this is a matter of state law, my opponent would not have had to look further than the “2022 COLA Frequently Asked Questions” page on the ERSRI website.[1] This website plainly states that “[m]unicipal plans that are a part of MERS” will receive a COLA once “the actuary determines the individual plan is at least 80% funded.” Importantly, “MERS plans are not aggregated,” meaning that once a particular community’s plan reaches the 80% threshold, they are eligible for an annual COLA irrespective of the funding status of other MERS plans. Even where plans are less than 80% funded – and consequently “do not provide a COLA to members” – pensioners will receive a COLA every four years under current state law, so long as the individual plan has adopted a COLA provision.

North Kingstown’s pension plan – which is a part of MERS – is only 78% funded, and therefore does not qualify for an annual COLA.[2] Its pensioners do – however – receive a four-year COLA. Moreover, my opponent has worked for several of the municipalities within MERS which received a COLA this year.[3]

[1] See 2022 COLA Frequently Asked Questions, https://ersri.org/retirees/benefit-payments/cola2022; see also COLA Information, https://ersri.org/retirees/benefit-payments/cola (“For MERS, COLAs are suspended until the funding level of the individual plan exceeds 80 percent – MERS plans are not aggregated.”) (emphasis added).

[2] See 2021 Actuarial Valuation Report, Municipal Employees Retirement System of Rhode Island, https://www.ersri.org/sites/default/files/2022-04/MERS2021_Final.pdf, at page 33.

Comments