Governor Ned Lamont today announced that three significant tax relief measures will take effect in Connecticut at the start of 2024, and among them are the largest income tax reduction ever enacted in state history, an increase in a tax credit targeting the lowest-income workers, and an expansion of exemptions on certain pension and annuity earnings to benefit seniors.

They are the result of the fiscal year 2024-2025 state budget that the Connecticut General Assembly approved and Governor Lamont signed into law this summer (Public Act 23-204).

In total, the three measures will reduce taxes for Connecticut taxpayers by approximately $460.3 million. Due to the fiscal guardrails and smart management of the state budget, nonpartisan analysts anticipate that revenue growth will exceed growth in fixed costs for the next several years. For example, General Fund revenue is expected to increase by $393.4 million from fiscal year 2025 to 2026 and fixed costs by $254.6 million for the same period.

“We enacted these tax relief measures to provide broad-based tax relief to those who need it, specifically middle-income workers, low-income workers, and seniors,” Governor Lamont said. “These tax cuts are possible due to the fiscal discipline that we’ve implemented over the last five years, which has stabilized the state’s fiscal house and ended a trend of too many years of deficits and uncertainty.”

One million tax filers to benefit from income tax cuts

Beginning on January 1, 2024, a reduction in Connecticut’s income tax rates will take effect, making this the first time that rates have been reduced in the state since the mid-1990s. It is also the largest income tax cut enacted in state history.

Connecticut has a progressive income tax rate structure, meaning that the tax rate increases with income at varying rates as income grows in each bracket. The changes enacted in 2024 will see a decrease in the two lowest rates:

- The 3% rate on the first $10,000 earned by single filers and the first $20,000 by joint filers will drop to 2%.

- The 5% rate on the next $40,000 earned by single filers and the next $80,000 by joint filers will drop to 4.5%.

The relief is targeted toward middle-class tax filers and is capped at $150,000 for single filers and $300,000 for joint filers.

The reduction is estimated to benefit more than one million tax filers.

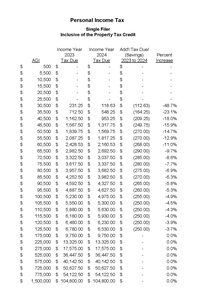

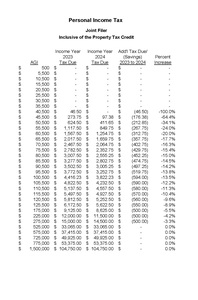

| CHART: Income tax rate reduction effective January 1, 2024 | |

Single Filer

|

Joint Filer

|

Connecticut’s Earned Income Tax Credit for low-income workers becomes one of the largest in the U.S.

Connecticut’s new Earned Income Tax Credit (EITC) change – which took effect retroactively for 2023 and will become available when recipients file their personal income tax returns in early 2024 – places the state among the top five in the nation with the largest rates on this popular tax credit program.

Under the change, the Connecticut EITC is increasing from 30.5% to 40% of the federal EITC. This will provide an additional $44.6 million in state tax credits to the approximately 211,000 low-income filers who receive the credit.

The Connecticut EITC is a refundable state income tax credit for the lowest-income working individuals and families that mirrors the federal EITC. Typically, more than 95% of filers who receive this credit are families with children.

| CHART: Connecticut’s Earned Income Tax Credit over the last decade | |

| Income Year | Credit Level |

| 2012 | 30.0% |

| 2013 | 25.0% |

| 2014 | 27.5% |

| 2015 | 27.5% |

| 2016 | 27.5% |

| 2017 | 23.0% |

| 2018 | 23.0% |

| 2019 | 23.0% |

| 2020 | 23.0% |

| 2021 | 30.5% |

| 2022 | 30.5% |

| 2023 (and thereafter) | 40.0% |

Expanding certain deductions for IRA distributions and pension and annuity earnings for seniors

Also effective in 2024 is an expansion of the state’s existing deductions for certain IRA distributions and pension and annuity earnings to benefit seniors. Specifically, the state budget eliminates the retirement income tax cliff by adding a phase-out for allowable pension and annuity and IRA distribution deductions against the personal income tax.

Approximately 200,000 filers benefit from the currently enacted retiree exemption limits. It is estimated that with these changes, an additional 100,000 filers could benefit from the elimination of the retirement cliff via the exemption phase-out.

| CHART: Pension and Annuities Exemption Phase-Out Schedule | |||

| Single, HOH, MFS Filers | |||

| Federal AGI | |||

| From | To | Pension Deduction | |

| 1. | – | $74,999 | 100.0% |

| 2. | $75,000 | $77,499 | $85.0% |

| 3. | $77,500 | $79,999 | 70.0% |

| 4. | $80,000 | $82,499 | 55.0% |

| 5. | $82,500 | $84,999 | 40.0% |

| 6. | $85,000 | $87,499 | 25.0% |

| 7. | $87,500 | $89,999 | 10.0% |

| 8. | $90,000 | $94,999 | 5.0% |

| 9. | $95,000 | $99,999 | 2.5% |

| 10. | $100,000 | and over | 0.0% |

| Joint Filers | |||

| Federal AGI | |||

| From | To | Pension Deduction | |

| 1. | – | $99,999 | 100.0% |

| 2. | $100,000 | $104,999 | 85.0% |

| 3. | $105,000 | $109,999 | 70.0% |

| 4. | $110,000 | $114,999 | 55.0% |

| 5. | $115,000 | $119,999 | 40.0% |

| 6. | $120,000 | $124,999 | 25.0% |

| 7. | $125,000 | $129,999 | 10.0% |

| 8. | $130,000 | $139,999 | 5.0% |

| 9. | $140,000 | $149,999 | 2.5% |

| 10. | $150,000 | and over | 0.0% |

Comments